A deferred compensation plan can be a great benefit for an executive or highly compensated employee. If your current (or former) employer has a DC plan and you qualify, it is essential to understand the plan’s contribution and distribution rules to make the best choices for your own financial plan. If you don’t pay attention to these details, and even if you do, you can be stuck with an unfortunate tax surprise the following April.

Some deferred comp plans delay distributing income until you are a certain age and/or make payments over some time. Other plans pay your benefit as a lump-sum in the same or following year of leaving the company. While all deferred comp plans require planning for your financial goals and lifestyle, the lump-sum payments are most likely to cause headaches in tax season.

How do these lump-sum payments result in additional taxes? There are two reasons.

The IRS mandated tax withholding for “supplemental wages” is 22% (unless income is over $1,000,000, then it is 37%).

If you change jobs, you may already have a base level of salary and a bonus of $250,000 or more.

For Example…

Scott and Susan are married and have a combined income of $350,000. Susan changed jobs last year after accepting an exciting new position that requires less travel. This year, she received a lump sum deferred compensation check from her previous company for $200,000. About $60,000 of income taxes were withheld (22% federal and 4.95% state) for a net payment of $140,000.

Scott and Susan are super-excited for these extra funds (which may or may not have been planned for retirement or other goals, but new money is new money!) and begin making decisions on how to spend it, including a $20,000 vacation for the family and a kitchen remodel.

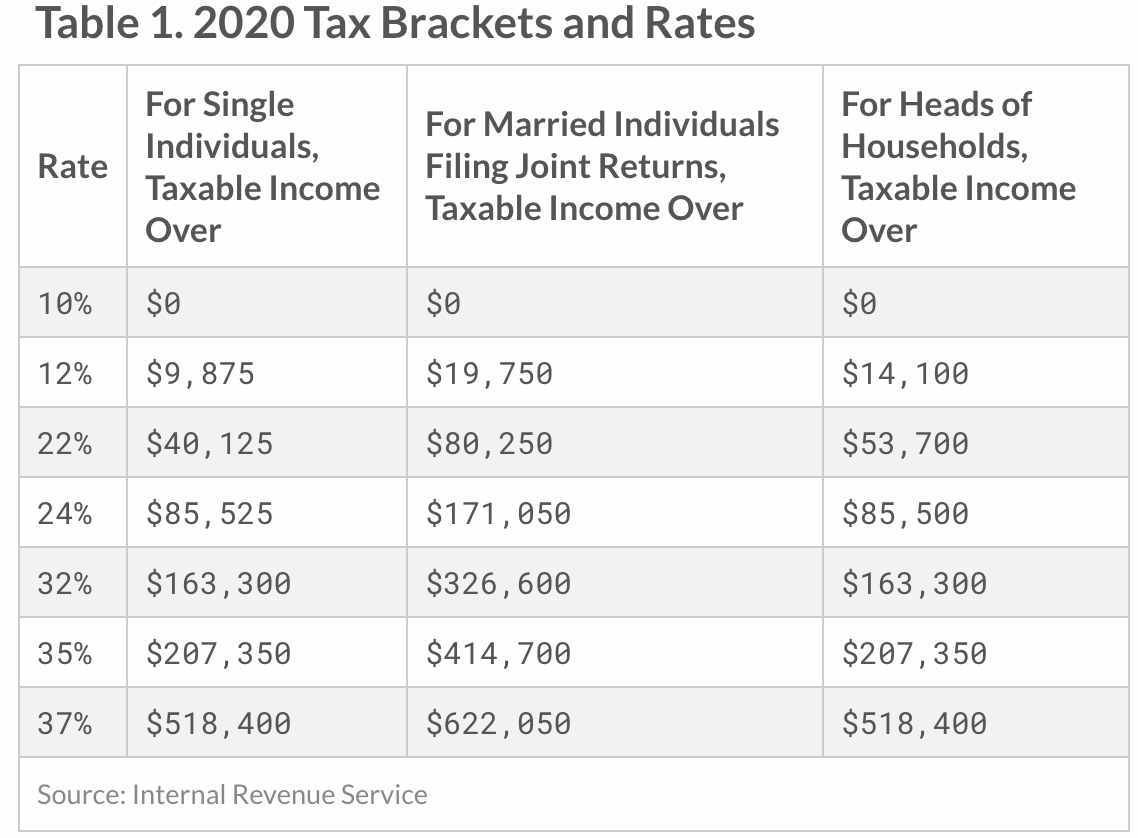

What Scott and Susan do not realize is that the federal taxes withheld are about 10% less than the amount they will owe to the IRS (see the tax bracket and rate table below). So come April next year, they will have an unfortunate tax surprise and owe an extra $20,000. To make matters worse, they make an additional $5,000 payment for estimated taxes, based on this year’s tax return and advice from their tax preparer. These amounts combine for a $25,000 tax headache, and they begin to regret their vacation and new kitchen.

The Solution

The good news is this surprise tax situation can be avoided with a little bit of tax planning. A proactive discussion with Scott and Susan's advisor when receiving the check could have identified the under-withholding of $20,000 in taxes and arranged for an additional tax payment. Then, a subsequent review and discussion on their final tax return could eliminate the need for estimated tax payments the following year.

Being aware and proactive with taxes is a much better place to be than surprised and reactive.

If you receive a deferred compensation payment, there are three crucial questions to ask.

Are the tax withholdings enough for my overall income situation?

How does this money affect my personal financial plan?

Does this additional income affect my estimated tax payments for next year?

If you do have these questions, I’m happy to listen and see if a proactive and tax-aware financial plan can help you. Just send me an email at hello@symmetrywealth.com.

(From The Tax Foundation https://taxfoundation.org/2020-tax-brackets/#brackets)