We are kicking off a short series on hidden income tax traps in retirement this week. Some of these topics might be on the forefront of your planning while in the rearview for others. These strategies and areas to consider can also change, so we must review and modify our plans accordingly.

The first tax trap is more of an opportunity. Or, perhaps it is a trap if planning is not done.

In talking to people thinking about retirement in the next five years, one of the most common questions and concerns I hear is:

How will I get health insurance after I leave my company?

Before 2014, this was a BIG question. And it still is in the minds of pre-retirees. Pre-existing health conditions, underwriting, and affordability were big unknowns when leaving a business (group) health insurance plan and joining the individual pool of people looking for health insurance.

The Affordable Care Act succeeded in eliminating two of those three concerns. The government now guarantees access to health insurance with little underwriting (smoking is the biggest one) and no restrictions on pre-existing conditions. Ironically, affordability is still a wildcard.

Retirees younger than age 65 can now rest easy with access to health insurance.

But how much does it cost?

It depends.

HMO plans tend to have a lower premium and narrower network of providers than PPO plans.

Premiums also vary based on the level of deductible. Bronze, Silver, and Gold are the deductible levels from high to low, with monthly premiums highest for the Gold plans.

A quick search on healthcare.gov showed that monthly premiums for PPO plans range from $900 – $1,200 – $1,400 for Bronze – Silver – Gold. This expense can be a sticker shock for people. This is where planning and something called the Premium Tax Credit come into play.

PTC – the Premium Tax Credit

Given the relatively high insurance cost, the ACA created the PTC to help taxpayers with lower income afford insurance. It is a complex formula based on income compared to “poverty level” ((FPL”), $18,310 in 2022 for joint couples. If your income is 400% or less of the FPL ($73,240), you can receive a tax credit to offset the premium. If you make more than 400% of FPL, no credit for you (as the Seinfield soup episode goes, “no soup for you")!

The COVID-response American Recovery Plan (ARP) further expanded tax credits so that average health insurance premiums are no more than 8.5% of income. Thus, taxpayers over the 400% FPL can now qualify for a tax credit. However, the ARP provision is only effective 2021-2022. Starting in 2023, "no credit for you"!

Planning Opportunities

Plan for increased spending for health insurance from retirement to age 65 (Medicare). One idea might be to have an extra $6,000/year per person budgeted or reserved for in a savings account.

Plan around various income levels to qualify for the PTC. Notice that the income level determines the tax credit, not asset levels. Someone with millions of investments can still receive the PTC to the extent that they can fund early retirement years with tax-friendly income. However, HSA accounts CAN NOT be used to pay for ACA insurance premiums. An HSA can be used to pay for deductibles and other out-of-pocket expenses. By strategically using tax-friendly accounts, an “early” retiree may qualify for the Premium Tax Credit.

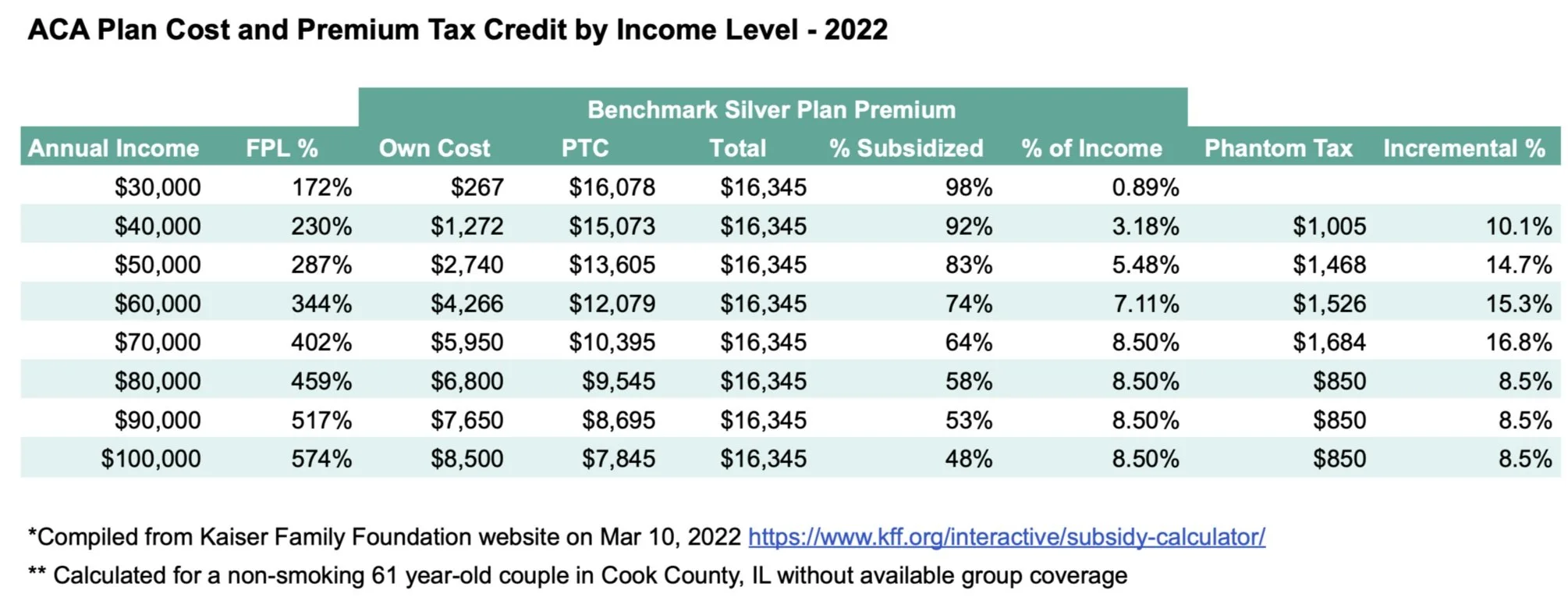

Below is a table showing the potential PTC at various income levels for a hypothetical couple. Note that when the American Recovery Act expires in 2023, the PTC goes to zero, starting at the $70,000 income level. You can see how that could be a big deal if PTC provisions are extended.

However, planning for the PTC can also result in some missed opportunities with converting IRAs to Roths at low tax rates OR harvesting capital gains at 0% tax rates. Some taxpayers may value tax credits today much more than potential benefits in the future. Others may feel better about losing some Premium Tax Credits to save more taxes over the long haul with Roth conversions or harvesting gains.

The moral of the story is that one of the first tax traps/opportunities in retirement is also one of the most overlooked. Personalized long-term planning can help you understand what options are available and the path to take.

P.S. By far, the Kaiser Family Foundation (KFF) has my favorite calculator for premium tax credit scenarios. You can find that here https://www.kff.org/interactive/subsidy-calculator/ and other great pieces of information on ACA and other healthcare-related topics.